Profit In Paradise - June 2025 - Rental Income & Occupancy in Blue Bay

- David Hecht

- Jun 20, 2025

- 2 min read

This month we looked at 3+ bedroom “upscale” and “midscale” properties in Blue Bay. 3 bedroom homes overwhelmingly dominate available Blue Bay Rentals.

A 3+ bedroom “upscale” property should expect an average of $607 USD in the high season and $334 USD in the low season. That seasonal pricing strength of approximately 81.7%, reflects strong rate elasticity and an opportunity for dynamic pricing strategies.

A 3+ bedroom “midscale” property should expect an average of $416 USD in the high season and $229 USD in the low season representing an 81.7% seasonal spread, mirroring the upscale segment.

An 81.7% seasonal pricing spread in both upscale and midscale Blue Bay properties reflects exceptional rate elasticity. This is a clear sign that demand surges during high season can be effectively monetized with the right pricing approach. It’s also indicative of seasonal lows. If your calendar isn’t adapting to these fluctuations, you’re likely undercharging when it matters most.

Instead of relying on a static pricing strategy, it behooves you to consider:

Tiered rate calendars that gradually adjust toward peak months

Incentivizing early bookings with perks or small discounts

Experimenting with minimum stay lengths

The seasonal spread represents an opportunity to engineer higher annual revenue, even if occupancy remains consistent.

Price Forecasts For BLUE BAY

Peak Pricing: The market shows a significant price spike in late December through early January, with prices exceeding $1,000 USD per night for premium properties.

Price Floor: From May through November, pricing flattens considerably across all segments. This is a prime opportunity to test discount strategies, weekly rates, or value-based offers to maintain occupancy.

Price Band Width: The spread between midscale and upscale listings narrows in low season, indicating less room for premium pricing unless the property is truly uniquely positioned.

Island Analytics

Market Overview

3BR homes dominate listings with a median price of $212 USD. If you own a 3BR, competition is high and smart positioning is critical.

4BR homes reach a 90th percentile price of $607 USD. These should be classified as upscale and the market supports that level during high season.

5BR homes reach as high as $669 USD, but they represent a small minority of the market. Pricing should reflect scarcity and emphasize exclusivity.

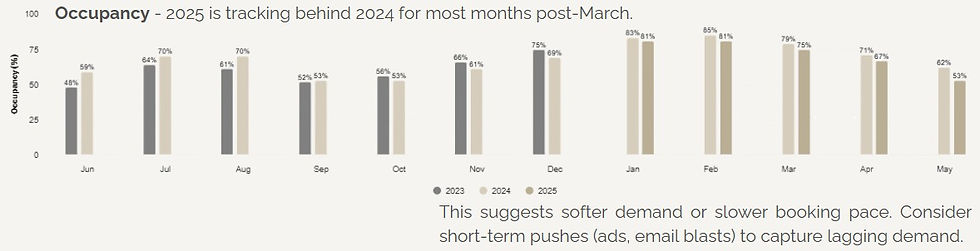

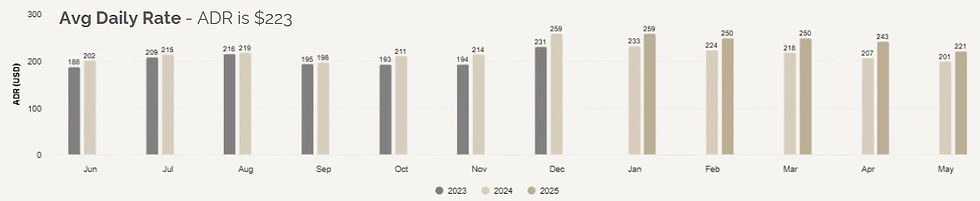

Blue Bay’s vacation rental market shows strong potential, particularly for 3- and 4-bedroom properties. With an average ADR of $223 and a seasonal pricing spread of 81.7%, well-positioned homes are in a position to nearly double their nightly rates during peak months. January and February remain the most lucrative with occupancy north of 80%, while post-April demand tapers off significantly. This quick shift highlights the importance of strategic rate adjustments and booking incentives during shoulder and low seasons. The 58-day average booking window and 6-night stay length suggests travelers plan moderately in advance when booking in Blue Bay. This data reinforces the need for a dynamic plan. Given that 3-bedroom homes dominate the inventory, standing out with thoughtful amenities, compelling visuals and tiered pricing is key to maintaining a competitive advantage.

For owners willing to adapt to market trends, Blue Bay offers a strong foundation for revenue growth year-round.

Comments