Travel Trends - December 2025 Curaçao’s Tourism Statistics

- David Hecht

- Dec 17, 2025

- 6 min read

What a strong close to the shoulder season! Curaçao welcomed 65,378 stayover visitors in November, representing +9% YoY growth. Visitors stayed an average of 8.3 nights, reinforcing steady, high-quality demand as the island transitions into peak season. Year to date, stayover arrivals now total 707,546, up 13% versus 2024, confirming that 2025 will be prove to be a structurally stronger year, not a one-off seasonal rebound.

What matters more than the headline growth is how that demand is forming. These results aren’t driven by a single market or a holiday spike. November shows a broad, balanced demand profile that carries clear implications for pricing discipline, calendar control and operational readiness.

Signals and Actions for Owners

The Signal: November demand widened, not spiked. Growth came from three directions at once. South America grew 21%, North America grew 19% and Europe grew 4%. At the same time, Caribbean arrivals softened sharply. This is not a holiday-driven surge from one market, but a multi-base demand layer forming underneath high season.

Why this matters:

When multiple regions contribute simultaneously, demand becomes more resilient and more predictable. In these conditions, pricing power no longer comes from chasing volume with discounts. It comes from calendar control, stay structure and discipline. This is the type of demand that reduces panic pricing, smooths occupancy and rewards owners who hold their nerve rather than give away nights too early.

The Action:

Treat November as a positioning month, not a discount month.

Hold your base nightly rate steady going into December and January.

Avoid blanket discounts to “lock something in.” November confirms demand is already diversified.

Shape bookings using minimum stay rules, gap control and arrival-day restrictions, instead of price cuts.

Owner Takeaway

November is no longer a soft shoulder month to manage through. It’s the foundation month that sets the tone for high season. Owners who protected pricing and structured their calendars well here are entering December with fewer reactive decisions, smoother operations and stronger revenue confidence.

This market rewards control over concessions.

WHO'S COMING AND FOR HOW LONG

Europe – Depth remains the anchor

Europe continues to define Curaçao’s winter stability through length of stay, not just arrivals. In November, Europe delivered 26,006 visitors (≈40% of arrivals) but accounted for a disproportionately high share of total nights, reinforcing its role as the island’s long-stay backbone.

The Netherlands remained the primary engine with 21,537 visitors (+3%), staying an average of 11.7 nights.

Germany, Belgium and Switzerland all posted steady gains, confirming that European demand is distributed, not concentrated in a single market.

Owner implication:

Europe is the segment that allows owners to hold pricing while reducing friction. Long stays lower turnover pressure, reduce operational wear and create calendar stability during peak months. This is where disciplined calendar protection pays off.

North America – Volume with velocity

North America recorded 22,105 arrivals (+19%), driven primarily by the United States.

The USA contributed 15,898 visitors (+8%), with an average stay of 5.8 nights, consistent with short-to-mid length winter escapes.

Canada stood out with 6,207 arrivals (+60%), staying an average of 8.1 nights, placing Canadians closer to European-style mid-length stays than U.S. weekend travel.

Owner implications:

North America brings volume, but it also brings speed. Homes that perform best in this segment are operationally tight: fast response times, clear instructions and seamless turnovers. Canadian guests, in particular, reward comfort and clarity over novelty or speed alone.

South America – Growth favors flexibility

South America delivered 13,596 arrivals (+21%), remaining the fastest-growing feeder region.

Colombia continues to drive strong visitation with shorter average stays, often clustering around extended weekends.

Argentina, Chile and Brazil further diversify the base. While Brazil softened in volume, it continues to deliver respectable mid-length stays.

Owner implication:

South American demand converts best when friction is removed. Flexible short-stay rules, clear Spanish communication and fast, predictable check-in processes materially improve booking conversion and guest satisfaction.

Caribbean – Fewer visitors, less noise

Caribbean arrivals declined sharply in November, continuing a trend toward fewer regional, price-sensitive stays.

Owner implications:

While overall volume is lower, the reduction in short, last-minute regional traffic lowers operational churn. For many owners, this translates into calmer calendars, fewer exceptions and smoother transitions into high season.

Owner Takeaway – Different markets require different decisions

November reinforces what we’ve seen build all year, that Curaçao is no longer driven by a single guest profile. What makes this month important is not who arrived, but what that mix requires from owners.

Each market now plays a distinct role:

Europe stabilizes revenue through longer stays and fewer turnovers

North America fills volume but demands operational speed and reliability

South America adds growth through flexibility and ease of booking

Reduced Caribbean traffic lowers friction rather than hurting performance

The mistake many owners make at this stage of the season is trying to apply one strategy to all guests. That approach increasingly underperforms.

What works instead:

Use calendar structure, not pricing volatility, to manage mixed demand

Protect long-stay lanes while allowing short stays only where they truly fit

Optimize operations for clarity, comfort and predictability rather than novelty

Owners who align rules, calendars and service levels to the role each market plays, instead of forcing uniformity, enter high season with smoother operations, fewer reactive decisions and more predictable revenue. The opportunity in November is not to be busier but better positioned.

Two Stay Lanes Dominate

Most bookings now fall into 4–7 nights and 8–14 nights.

Use them differently:

4–7 nights: fill gaps and drive volume

8–14 nights: protect blocks to stabilize revenue and reduce turnovers

Stop optimizing around “average stay.” It underperforms.

Arrivals Are Compressed

Arrivals cluster toward Friday–Saturday and mid-day to early evening.

Plan for peaks, not averages:

Schedule cleaning and checks around arrival waves

Expect late-day check-ins

Make first-hour basics frictionless: access, lights, AC, Wi-Fi

Most issues start before guests unpack.

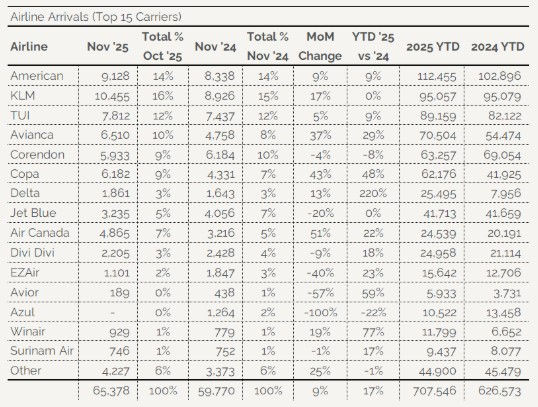

Airlift - operational signals for owners

November’s visitor growth was supported by stronger utilization of existing flights, not new or experimental routes. For owners, the relevance of airlift is no longer about airline names or route counts — it is about when guests arrive, how they arrive and what condition they arrive in.

What Owners Need to Prepare For

Arrival patterns are compressed. Arrivals are clustering into predictable afternoon and evening waves, particularly from North America. Same-day turnovers are becoming denser, not more chaotic.

Be ready for late-day check-ins, reduced flexibility around early access and higher sensitivity to delays.

Arrival fatigue is real. Guests are arriving warm, travel-tired and task-focused, not exploratory. Their tolerance for friction is lowest in the first 30 minutes inside the home.

Be ready for immediate expectations around access, lighting, cooling and connectivity.

Short booking windows raise the cost of confusion. South American and North American bookings are coming with shorter lead times. Any uncertainty in pre-arrival communication shows up as stress on arrival.

Be ready for clear instructions, minimal steps and fast confirmations, especially in the final 48 hours.

What to Do Differently This Season

Align cleaning and check-in schedules to actual arrival waves, not ideal timelines

Make late arrivals foolproof: access codes sent early, lights on, AC pre-cooled

Remove unnecessary pre-arrival steps for short lead-time bookings

Assume guests arrive depleted, not patient

Owner Takeaway

Airlift shapes arrival timing, guest energy and tolerance for friction. Owners who prepare for how guests arrive, rather than focusing only on how many, experience smoother turnovers, fewer after-hours issues and stronger first impressions. The advantage in November is not more flights. It is operational readiness.

Closing Insights For Owners

November’s data confirms what the full year has been signaling: Curaçao is moving beyond sharp seasonal swings and towards a more predictable, multi-market rhythm. Growth is no longer dependent on one country, one month or one travel pattern. It’s being earned through consistency. For owners, this changes the job.

The opportunity going into 2026 is no longer about chasing demand or reacting to peaks. It is about executing well inside a stable system. Owners who performed best this year will have shared a few common behaviors:

They structured calendars around how guests actually stay, not averages

They protected longer blocks while allowing short stays only where they truly fit

They designed operations for arrival reality, not idealized check-in times

They prioritized clarity, comfort and reliability over novelty

These are not marketing tactics but operational disciplines. The gap in performance is increasingly coming from execution, not exposure. Homes that feel organized, predictable and professionally run are capturing disproportionate value, even at similar occupancy levels.

Final owner takeaway

Curaçao’s tourism story is no longer about momentum alone. It’s about management quality. Owners who align pricing, calendars and operations to real guest behavior will experience calmer turnovers, fewer last-minute decisions and more reliable returns, while delivering stays that feel as considered and effortless as the island itself. The advantage is no longer being early but being well prepared.

Comments